The par value of the common stock nowadays is usually just the number on the paper. The additional paid-in capital is a part of total paid up capital that increases the stockholders’ equity. Once set, the par value of stock remains fixed forever unless the issuing company executes a forward or reverse stock split to increase or decrease the number of its outstanding shares. The company needs to record cash consideration and reverse the treasury stock.

3 Accounting for the issuance of common stock

Some companies may also have other options when raising finance from this source. Usually, this involves preferred stock, which differs from common stock. Par value may be any amount—1 cent, 10 cents, 16 cents, $ 1, $5, or $100. At its most basic, common stock is a financial instrument representing a share of ownership in a company.

Issuance of common stock at price higher than par value

Common stock is a financial instrument that represents the ownership of a company. In accounting, this term describes the total finance received from a company’s shareholders over the years. Companies may also refer to it as ordinary stock, which represents the same concept. In most circumstances, common stock is the only type of equity instrument that companies may issue. According to the information provided, Kellogg has acquired nearly thirty-seven million treasury shares.

Journal entries for the issuance of par value stock

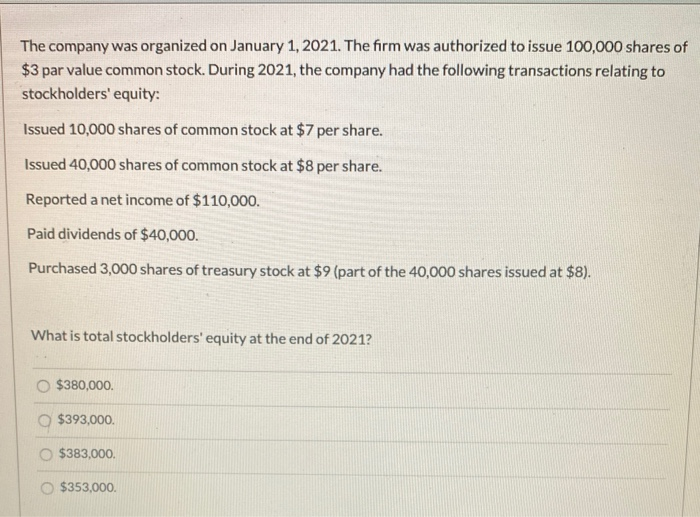

In the later section below, we will illustrate how to record the journal entry for the issuance of common stock. This includes the issuance at par value, at no par value, at a stated value, and the issuance for non-cash assets. The total amount of stock currently in the hands of the public turbotax review for 2021 is referred to as the shares “outstanding.” Shares are sometimes bought back from stockholders and recorded as treasury stock. Thus, originally issued shares are not always still outstanding. According to the information provided, Kellogg has acquired over million treasury shares.

Examples With Journal Entries

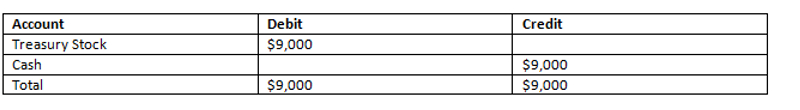

However, the legal capital of the DeWitt Corporation is $200,000. The first example we will go through is the sale of common stock by ABC Ltd for cash. And in the last example, we will look at is a company buying back its own stock. This process is often referred to as a share buy-back or a Treasury stock purchase. Once the shares are purchased back from shareholders, the company can either hold them as Treasury stock or cancel them, which is the permanent retirement of the shares.

The company plans to issue most of the shares in exchange forcash, and other shares in exchange for kitchen equipment providedto the corporation by one of the new investors. Two common accountsin the equity section of the balance sheet are used when issuingstock—Common Stock and Additional Paid-in Capital from CommonStock. Common Stock consists of the par value of all shares ofcommon stock issued. Additional paid-in capitalfrom common stock consists of the excess of the proceeds receivedfrom the issuance of the stock over the stock’s par value.

For instance, some businesses will issue stock in exchange for tangible assets or real property. As mentioned, the share capital account will only include the par value of the shares. The excess amount of $50,000 ($150,000 – $100,000) ended up on the share premium account. The debit side will include the full amount of the finance received. As mentioned, this account will only hold the par value for the shares issued by the company.

Each share of common or preferred capital stock either has a par value or lacks one. The corporation’s charter determines the par value printed on the stock certificates issued. Par value may be any amount—1 cent, 10 cents, 16 cents, $ 1, $5, or $100. For most companies, issuing stock is one of the most accessible sources of finance. Usually, the most common type of this source includes common stock, also known as ordinary stock.

Typically, shares have a par value of $0.01 or $1.00 etc., normally a round figure. From an accounting point of view, the actual par value matters little until we get to an issue price that is different to the par value. And we’ll look at this very thing in the examples coming up below.

To illustrate this, let’s assume that ABC Corporation issues1,000 shares of no par value common stock at $50 stated value for $60 cash per share. As you can see from the journal entry above, the total common stock equal to the cash received from investor. Par value stock is a type of common or preferred stock having a nominal amount (known as par value) attached to each of its shares. Par value is the per share legal capital of the company that is usually printed on the face of the stock certificate. It is also known as the stated value and face value of stock.

- Corporations often set this figure so high that they never have to worry about reaching it.

- If there isno balance in the Additional Paid-in Capital from Treasury Stockaccount, the entire debit will reduce retained earnings.

- Assume that onAugust 1, La Cantina sells another 100 shares of its treasurystock, but this time the selling price is $28 per share.

- The general rule isto recognize the assets received in exchange for stock at theasset’s fair market value.

- Common stock has also been mentioned in connection with the capital contributed to a company by its owners.

For small stock dividends, retained earnings are debited at the market value of the shares being issued, with credits to both the common stock and APIC accounts. Even though the company is purchasing stock, there is no assetrecognized for the purchase. Immediately after the purchase, the equitysection of the balance sheet (Figure14.6) will show the total cost of the treasury shares as adeduction from total stockholders’ equity. Sometimes a corporation decides to purchase its own stock in themarket. A companymight purchase its own outstanding stock for a number of possiblereasons. It can be a strategic maneuver to prevent another companyfrom acquiring a majority interest or preventing a hostiletakeover.

بدون دیدگاه